Features

Change to Account Update and Line Item Update Webhooks

The payloads for the

account_update and

line_item_update webhooks include a list of changes that have occurred since the last webhook for the same account or line item, which are under the

data.changes attribute. The list of changes is an array where each element has the new value, the previous value, and the name of the field that has been changed.

This release updates the field name of each change to be the full address of the changed field, rather than just the name of that field.

- Previous Behavior =

"field_name": "account_status"

- New Behavior =

"field_name": "account_overview.account_status"

{

"new_value": "VALID",

"field_name": "line_item_overview.line_item_status",

"previous_value": "PENDING"

}

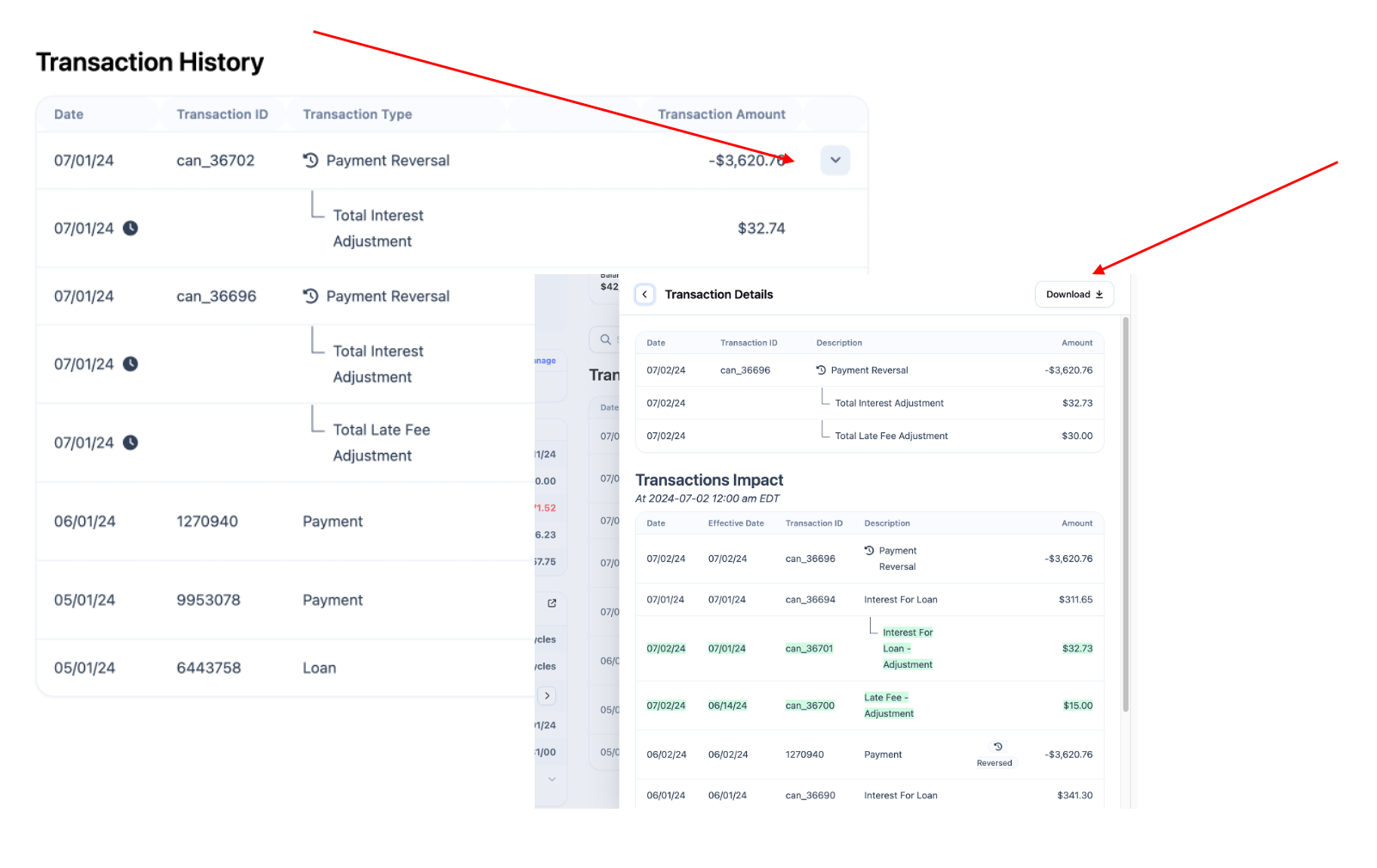

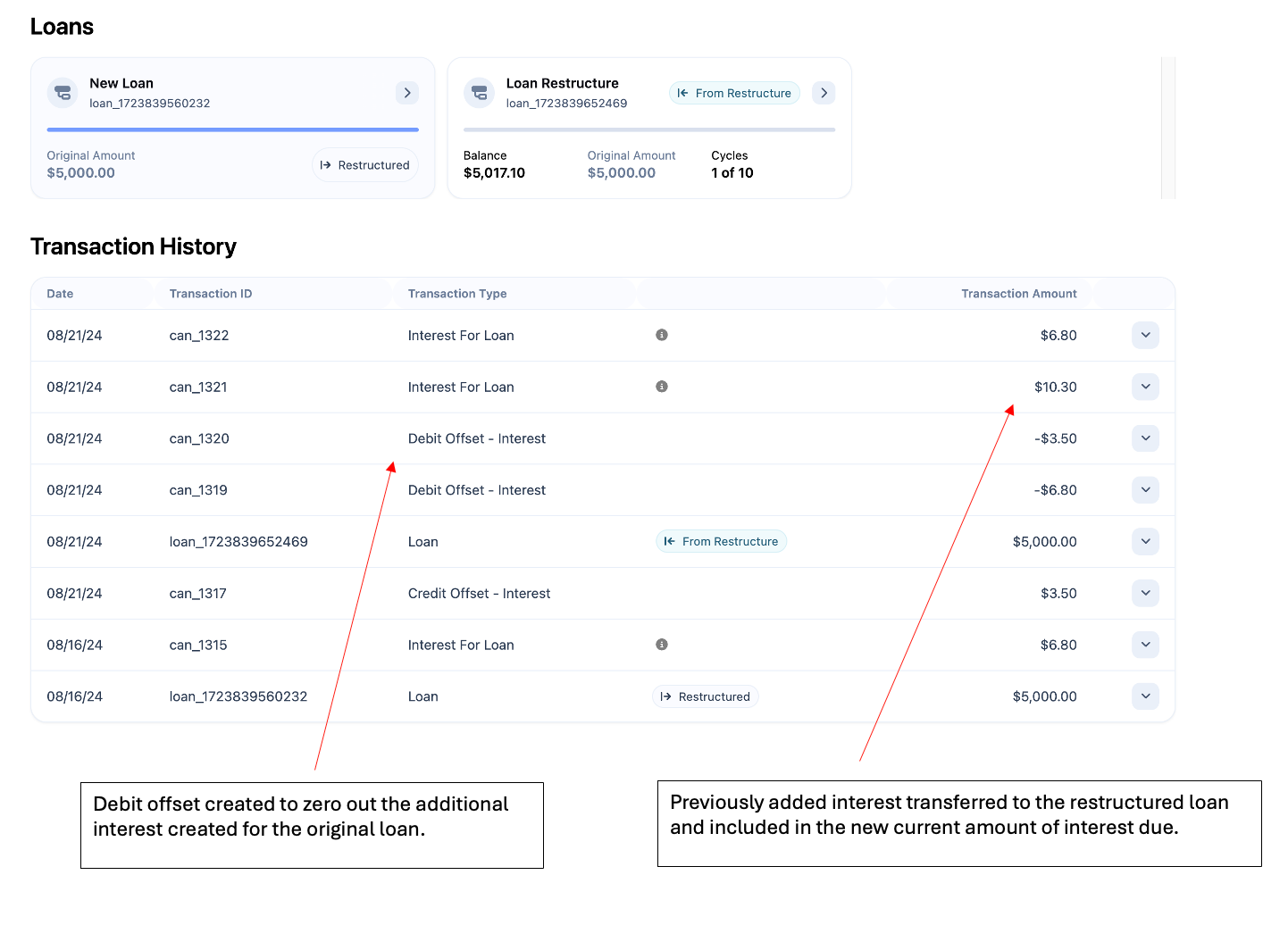

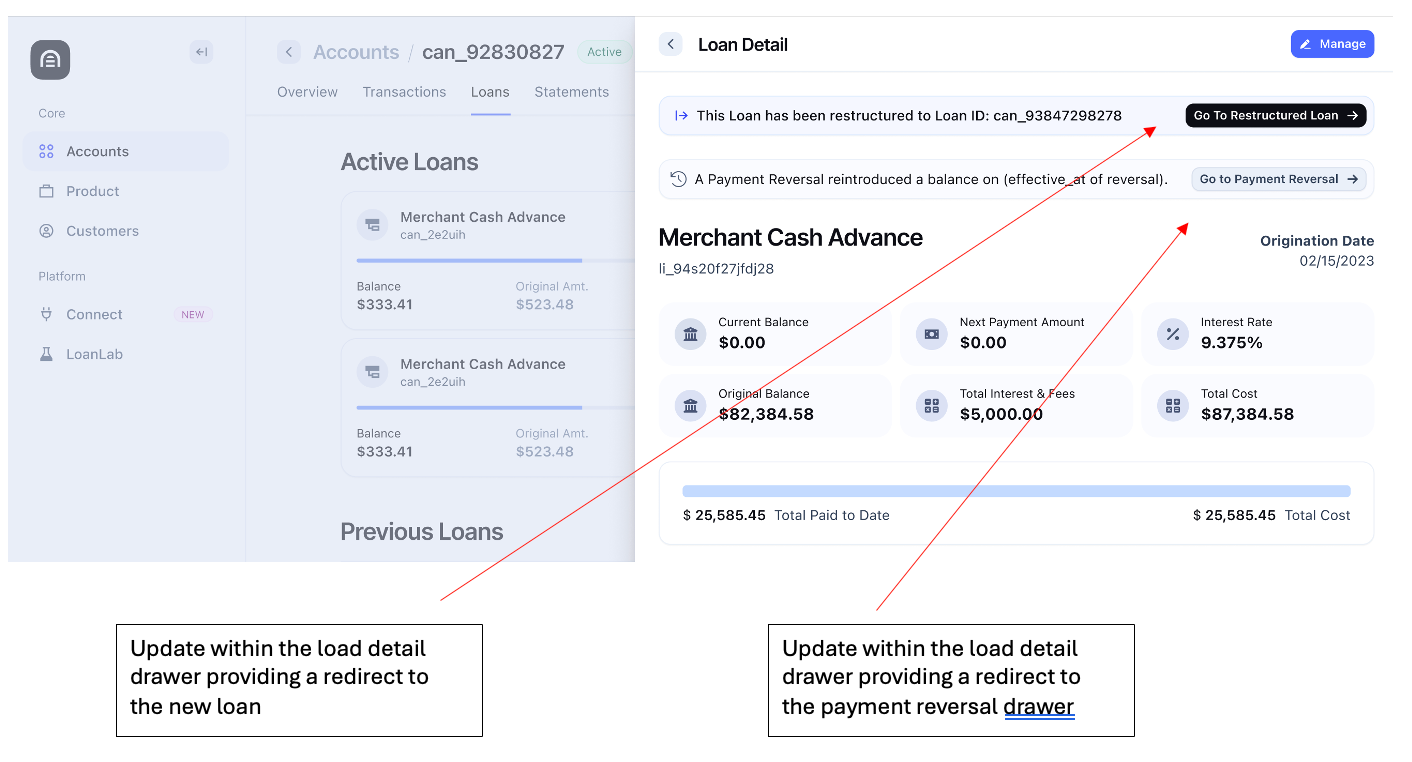

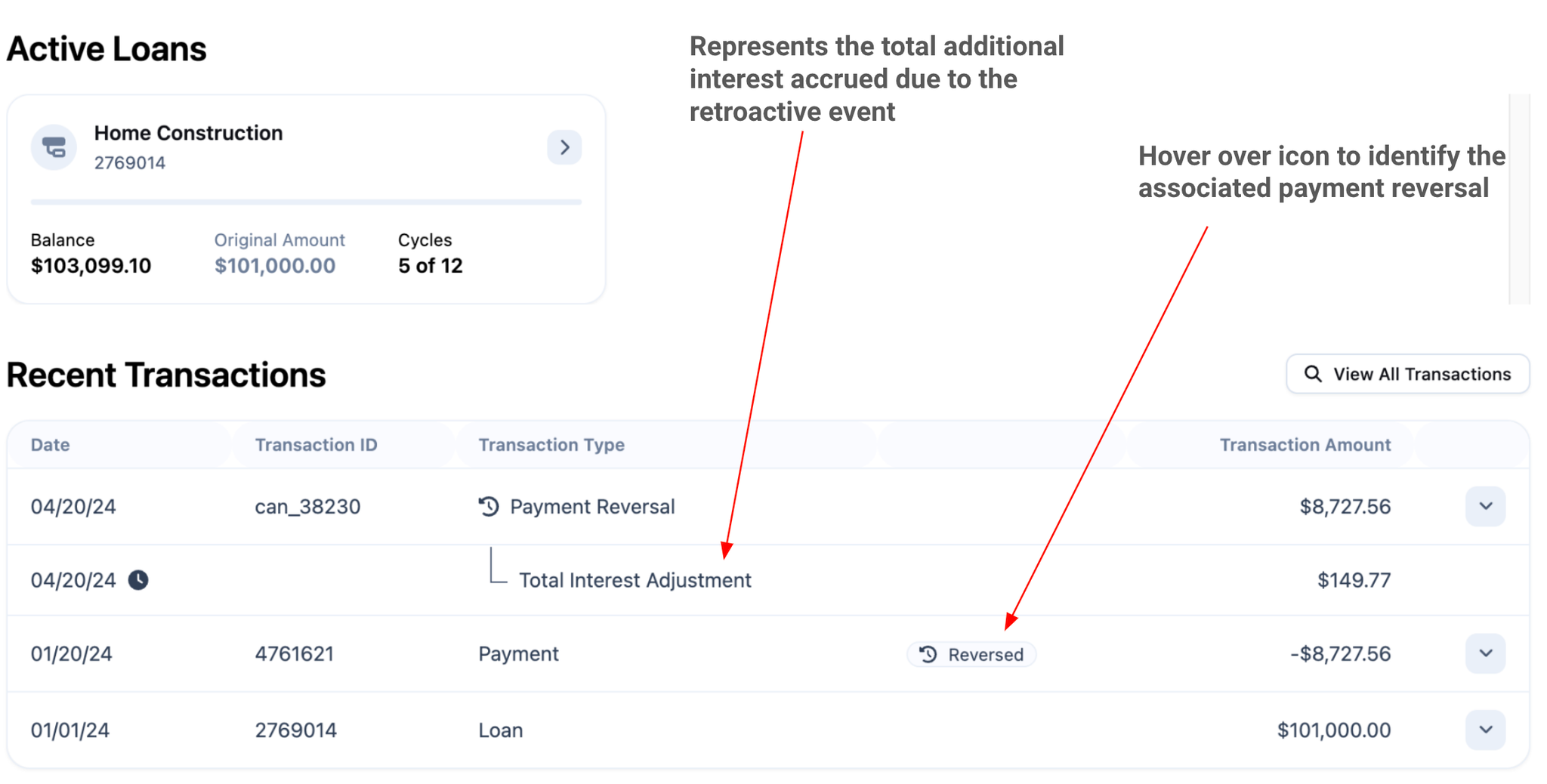

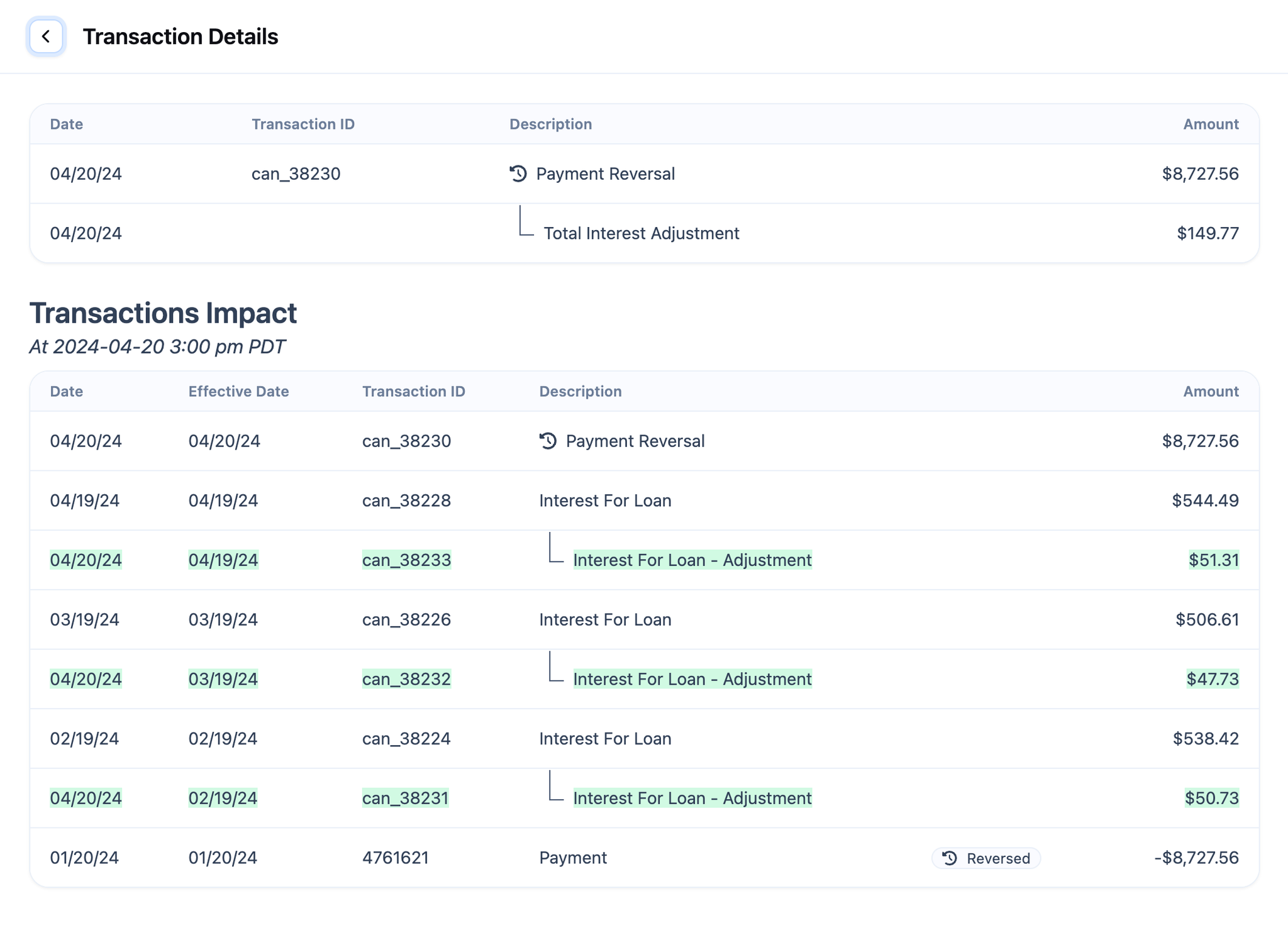

Reversals on a Restructured Loan

As another enhancement to our recently launched

Reversals features, we now support performing a reversal on a payment that was made on a loan that has since been restructured.

In such a case, the outcome of a restructure is not affected by the changes of the payment reversal itself. The payment reversal will still correctly adjust line items that the payment has poured into, including the original, restructured loan, but any increase to the original loan's principal will not be moved to the restructured loan. This enhancement does not currently support:

- Reversing a payment on a loan that has been restructured if the payment has been an overpayment

- Reversing a payment on a loan that has been restructured using the capitalization interest and fee handling

Support for these two cases will be part of a future release.